Join us to build a financial legacy for Black Bear football

John R. Huard, Sr. ’67 Football Fund

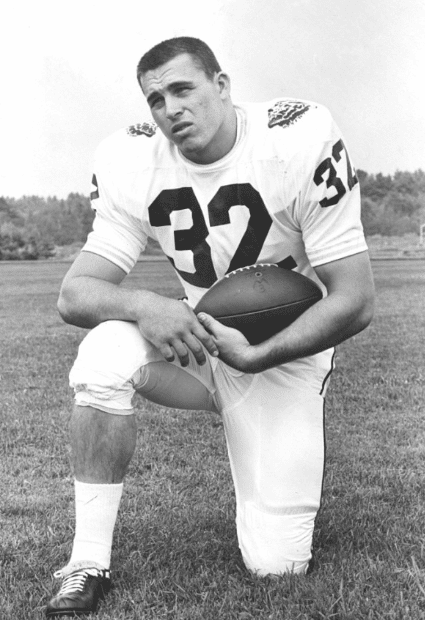

CELEBRATING UMAINE’S OWN HALL OF FAME FOOTBALL STAR AND CREATING A SOLID FUTURE FOR THE PROGRAM

About the John R. Huard, Sr. ’67 Football Fund:

ESTABLISHED IN THE SUMMER OF 2019, the Huard Fund was created to honor UMaine football legend John Huard ’67 and provide a vehicle for planned giving support for the University of Maine Football program. Huard is commonly known to sports fans as one of the greatest football players to come from the state of Maine. As a Maine native, his career is one of the most storied in the history of Black Bear Football. In 1965, he led the defense to a historic season as the Black Bears won the Yankee Conference and played in the Tangerine Bowl game. Huard was inducted into the National Football Foundation Hall of Fame in December of 2014, becoming the first Black Bear to receive this prestigious honor.

The Tangerine Bowl team was inducted into the University of Maine Sports Hall of Fame in September of 2019. John’s teammates came together to establish the Huard Fund to support the football program in perpetuity by promoting planned gifts to the program and to honor Huard for his storied career as a player and coach at many levels of football. There are many ways to make a gift to this fund and become part of the Black Bear Football Legacy.

Cash gifts

Maximize your charitable deduction and deliver immediate benefits to the University of Maine. Cash gifts can be in the form of a check, credit or debit card. Gifts may be processed online at our.umaine.edu/huard.

Appreciated Securities

One of the most significant tax breaks comes from gifts of appreciated securities. A gift of long-term appreciated securities has two major advantages: it provides the donor with an income tax deduction and eliminates any capital gains taxes to the extent allowable by tax law.

Real Estate

Make a substantial gift to the University of Maine Foundation through a transfer of real estate. A residence, forest land, or other real estate property may be given to the Foundation as an outright gift, or you may prefer to donate your property to the Foundation and retain the right to occupy the property for life.

A gift of a remainder interest in a personal residence or farm provides you with a current income tax deduction for the present value of the remainder interest and also permits you to eliminate any capital gains taxes on the appreciation.

Tangible Personal Property

Donate books, artwork, or equipment and secure an income tax deduction. The allowable deduction for a gift of such property is dependent upon an appraisal and its

related use.

Bequests

A provision for the University of Maine Foundation in your will allows for a substantial contribution without diminishing assets during your lifetime. Sample bequest language here.

For more information on giving options, contact:

Seth Woodcock

Senior Associate Athletic Director

for Development

Email Seth

207.318.5910

Life Insurance

New Policy – You can find a future gift for us from your income or through a single premium policy.

Paid Policy – A paid policy which is no longer needed can be transferred as a gift to the Foundation.

Gift Replacement – Create a life-income gift for yourself; use insurance proceeds to restore the value of your gift to benefit your heirs.

Charitable Lead Trust

Discover an innovative way to pass appreciating assets on to family members while making gifts in the interim. Income is paid to the Foundation each year during the life of the trust. When the trust terminates, the assets revert to the donor or another beneficiary.

Life Income Plan — Pooled Life Income Funds

Gifts to one of the Foundation’s Pooled Life Income Plans are invested jointly with other gifts to the funds. Income earned by the Funds each year is shared among the participants proportionately. Donors incur no capital gains taxes on the transfer of appreciated long-term securities and receive a charitable deduction for a portion of the gift while receiving lifetime income. The fund may be designated for any purpose at the University of Maine.

Charitable Gift Annuity — Immediate

You receive a life income, determined by your age, in exchange for your charitable gift and qualify for multiple tax advantages. You receive an immediate income tax deduction for a portion of your gift. Your lifetime annuity is backed by a reserve and the full assets of the Foundation. Your annuity payments are treated as part ordinary income, part tax-free income and part capital gains income for gifts of securities.

You have the satisfaction of making a significant gift that benefits you now and the University of Maine later.

Charitable Gift Annuity — Deferred

A deferred charitable gift annuity is recommended for younger donors to build retirement earnings for the future, or for grandparents who wish to help grandchildren with college expenses. You transfer cash or securities to the Foundation.

On a specified date in the future, the Foundation begins to pay you, or up to two annuitants you name, fixed annuity payments. The remainder is endowed at the Foundation when the contract ends.

Life Income Plan — Charitable Remainder Trusts

Make a large gift and receive a payout each year. An irrevocable trust may be used to provide the donor or loved one with a fixed annual income or an income which varies with the value of the trust. A portion of the trust qualifies for an income tax deduction. At the death of the last income beneficiary, the assets in the trust are distributed to the Foundation to be used as the donor designated.