The Many Ways to Give: Supporting the Future of UMaine

Giving to the University of Maine is more than a donation—it’s an investment in the future. Whether you’re passionate about supporting students, advancing research, or strengthening campus resources, there are multiple ways to make a meaningful impact. Here are four key ways donors contribute to UMaine’s success.

Annual Fund Support: The Power of Immediate Impact

Annual giving provides flexible, unrestricted funds that support the university’s most pressing needs, from scholarships to faculty development and student programming and emergencies. These gifts, often given on a yearly basis, create an immediate impact, ensuring that our students and faculty have the resources they need to thrive. Even a small donation can collectively make a big difference in enhancing the university experience.

Capital and Major Gifts: Transforming the Campus and Beyond

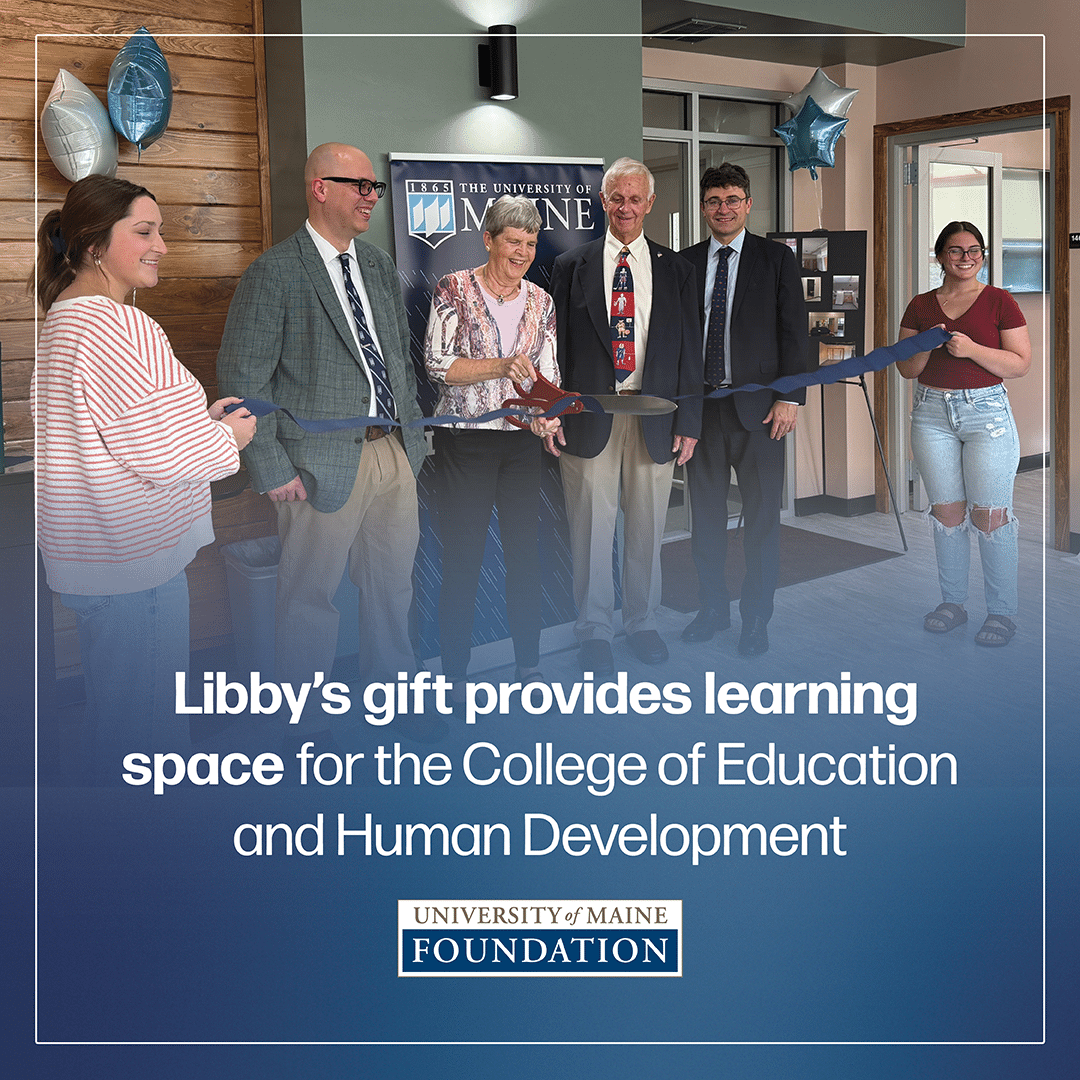

Major gifts and capital contributions fund large-scale initiatives such as new buildings, research centers, and endowed professorships. These contributions leave a lasting legacy by providing long-term benefits for generations to come. Whether it’s naming a classroom, funding a research initiative, or supporting a specific college or department, major gifts help shape the future of the university in profound ways.

Endowed Scholarships: Perpetual Support

A named endowed scholarship is one of the most meaningful ways to create a lasting impact. These funds are invested, and only the earnings are used to provide scholarships year after year, ensuring that UMaine students receive financial support in perpetuity. Donors who establish endowed scholarships help open doors for talented students who may not otherwise afford a college education, leaving a legacy that will continue for generations.

Planned Giving: A Legacy for the Future

For those who wish to make a lasting impact, planned giving offers an opportunity to include gifts to the UNIVERSITY OF MAINE FOUNDATION to benefit UMaine through the in their estate plans. Through bequests, charitable trusts, or beneficiary designations, donors can create a legacy that supports students and programs well into the future—all while achieving their own financial and philanthropic goals.

Signed into law on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) alters the federal tax rules related to claiming a tax deduction for charitable donations. For those taking the standard deduction, beginning in 2026, you can also deduct up to $1,000 (single filers) or $2,000 (married couples filing jointly) for gifts directly to the University of Maine Foundation.

What’s Your Philanthropic Vision?

No matter how you choose to give, your support helps strengthen our university community. We’d love to help you explore the giving options that align with your values and goals. Let’s start the conversation today.

2025 Annual Report

Celebrating Tradition, Connection, and Generosity.

This year, the University of Maine celebrated 160 years, and the University of Maine Alumni Association will celebrate its 150th anniversary. Last year, the University of Maine Foundation celebrated 90 years of service. With all that in mind, we are reflecting on the traditions that bind us together.

Highlights: Another record-breaking fundraising year, new funds in FY25, and the sources of 2025 giving.

News

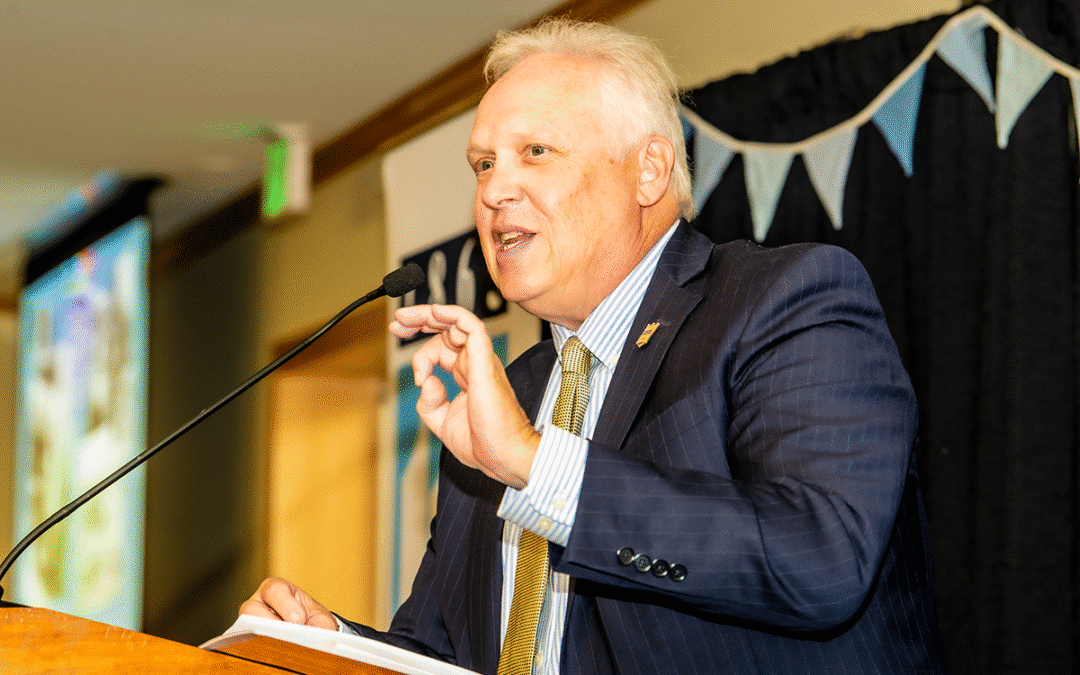

President/CEO Appointed to Two National Leadership Committees

Orono, Maine — The University of Maine Foundation is pleased to announce that President/CEO Jeffery N. Mills has been selected to serve in leadership roles on two of the nation’s most influential professional committees for higher education fundraising and foundation...

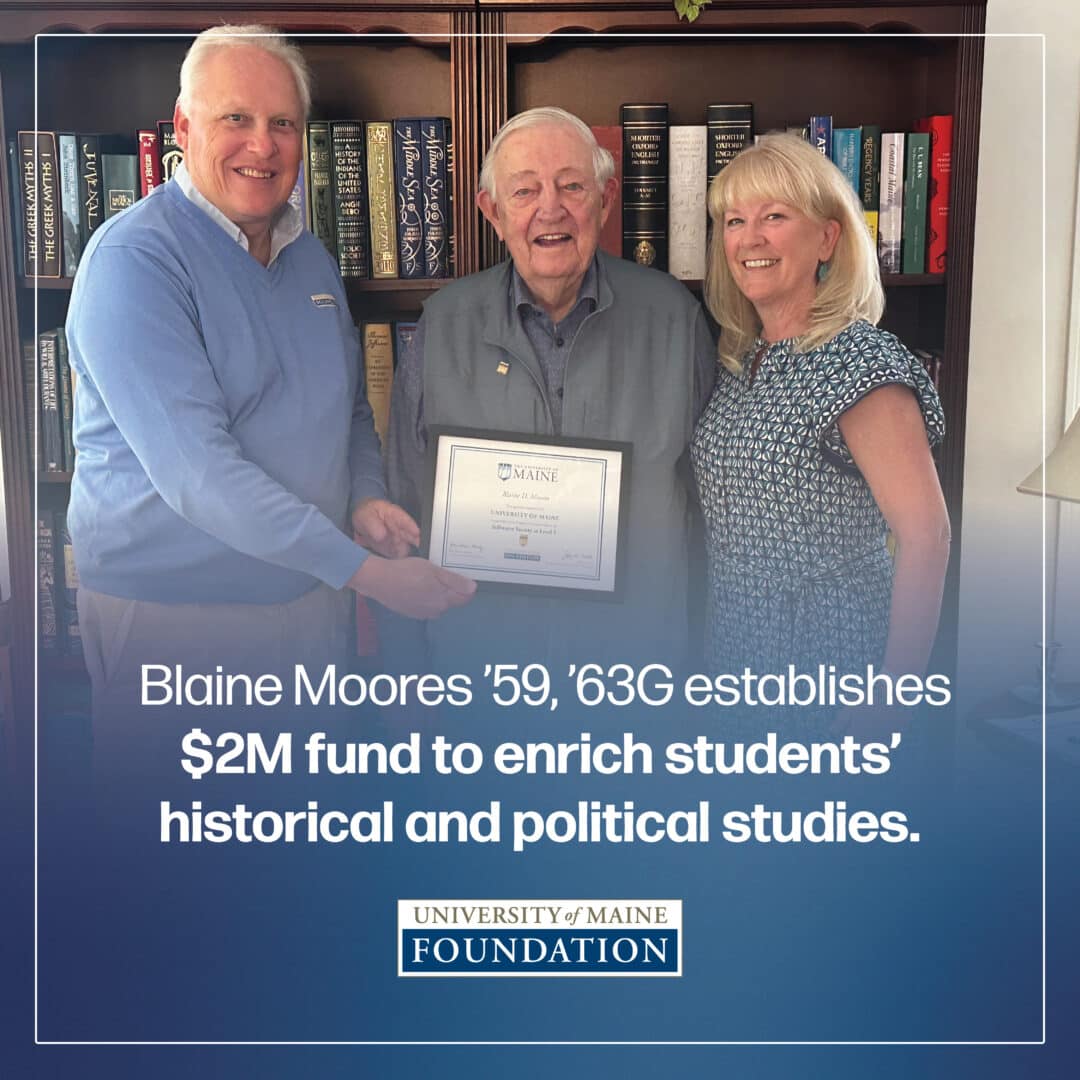

UMaine alum establishes $2M fund to enrich students’ historical and political studies

University of Maine Foundation President/CEO Jeff Mills (left) and Associate Director Dee Gardner (right) presenting Blaine Moores (center) with his acceptance into the Foundation’s Katahdin Society during a meeting celebrating his tremendous gift.ORONO,...

Current Special Giving Campaigns

This fall we will be celebrating the University of Maine Classes of 1951, 1956, 1961, 1966, 1971, 1976, 1981, 1986, 1991, 1996, 2001, 2006, 2011, 2016, and 2021. Your gift might qualify for a match from the University of Maine Foundation!

Isaac Webber

Isaac Webber Finds Purpose and Possibility in Engineering at UMaine Support from the Harold “Brownie” Brown Scholarship Fund has helped mechanical engineering student Isaac Webber focus fully on his education at the University of Maine, giving him the freedom to...

Alan Chausse

Alan Chausse Finds Community and Hands-On Learning Through the Schomaker Scholarship Alan Chausse’s UMaine experience has been shaped by hands-on learning opportunities, community, and the generosity of donors. “The scholarship has allowed me to focus on enriching...

Chinonye Anumaka

Chinonye Anumaka Advances Her Global Health Goals with Support from the Webber Scholarship For Chinonye Anumaka, the John M. Webber School of Business Scholarship has been a tremendous blessing, helping ease the financial burden of graduate study while allowing her to...

Emily Maniscalco

Emily Maniscalco Builds Confidence and Connection Through the Worrick Scholarship For Emily Maniscalco, the Robert C. and Roberta S. Worrick Scholarship has made a life-changing difference in her ability to pursue higher education as a nontraditional student. “This...

Gifts in Memory

Any gift you make may be in honor or in memory of someone. Specific people being honored with memorial gifts are listed on the gifts in

To set up memorial giving please visit the create a memorial giving opportunity page.